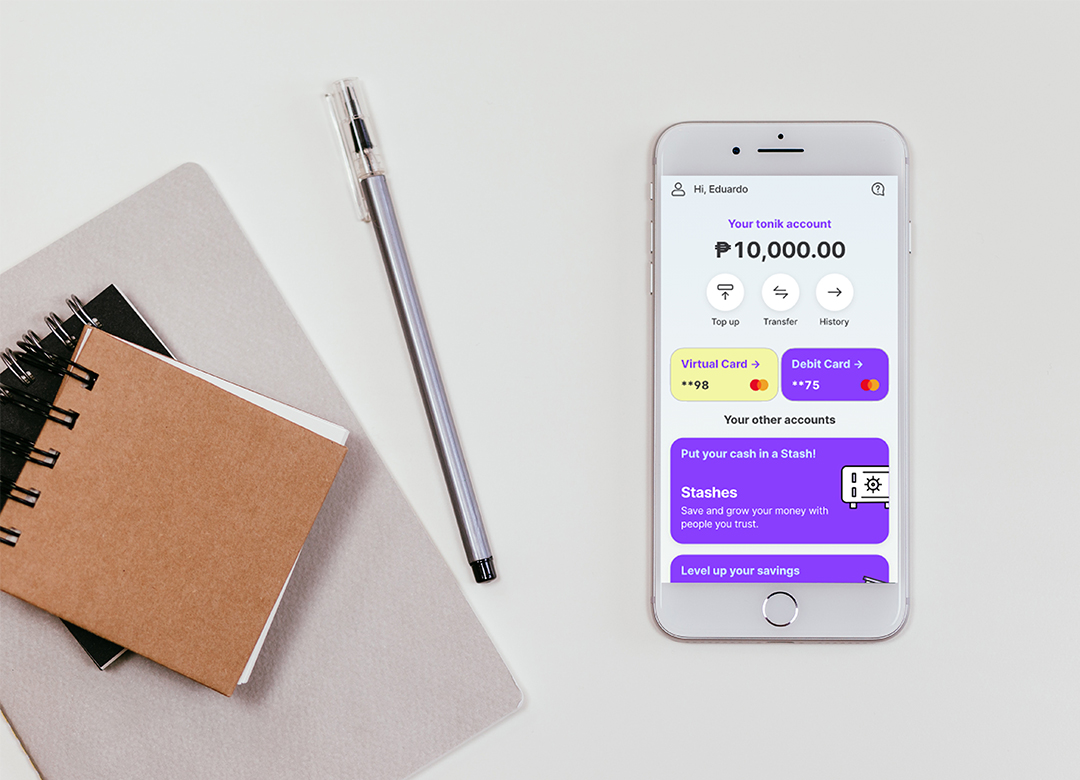

Tonik has now officially available in the Philippines. It is Southeast Asia’s first digital-only bank and the first neobank in the Philippines. Start signing up now, it will only cost you 5 minutes to create an account because of its simple process. Don’t worry, Bangko Sentral ng Pilipinas (BSP) already issued a bank license to Tonik. Besides, Philippine Deposit Insurance Corporation already insured its deposits.

This digital bank offers high-interest rates for their dedicated savings account called “Stashes”. In this Stashes feature, you have the option to save money solo or by a group. For the solo, it gives you a 4% interest rate per annum, while a 4.5% interest rate per annum for the group Stash. Also, its time deposits have a 6% interest rate per annum.

However, the Stashes feature will motivate you to save because you can personalize each Stash to what do you save up for. Besides, you can also add a photo to your Stash for added. It truly pushes us to start saving now because of its incredible interest rates and features.

You will have a virtual Mastercard debit card after you created an account in Tonik. You can use this for several online merchants. Besides, Tonik plans to have a physical debit card and also to have an all-digital consumer loan service soon.

Indeed, banks are now within our reach, we can now have a bank account using our mobile phones through digital banking. We are glad that banks like Tonik consider this situation we experience, to provide solutions to what people need.

For more details, check their website: Tonik